Artificial Intelligence (AI) has been increasingly used in the insurance industry. AI-powered insurance services have helped insurers to reduce costs, improve customer service, and provide better coverage to customers. In this article, we will discuss how AI insurance services can help your business.

Benefits of AI Insurance Services

AI insurance services offer numerous benefits to businesses. Here are some of the most important ones:

1. Streamlined Processes: AI insurance services can help streamline processes and automate mundane tasks. This can free up time and resources that can be used more efficiently to focus on other tasks. If you want to get the service of AI insurance then you may navigate to this website.

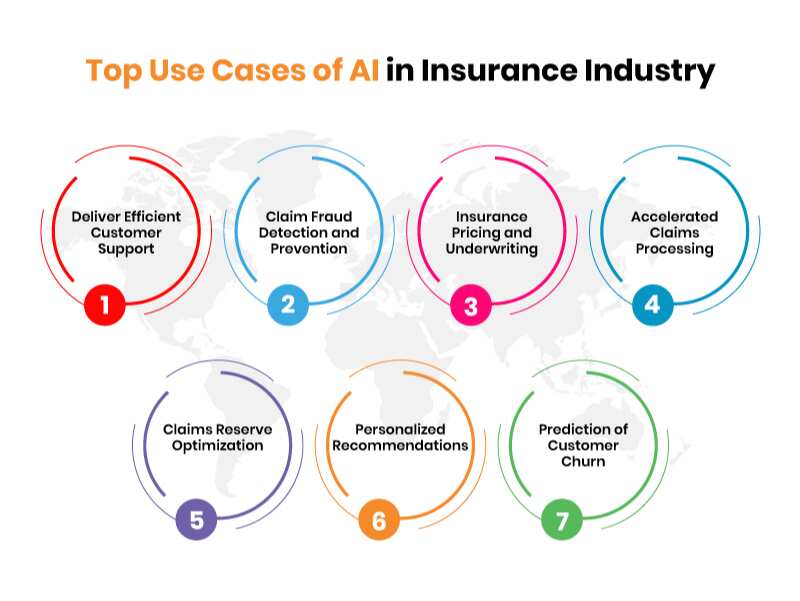

Image Source: Google

2. Improved Risk Assessments: AI insurance services can help insurers to assess risks more accurately. This can help to reduce the cost of claims and improve the overall customer experience.

3. Increased Efficiency: AI insurance services can improve overall efficiency by automating processes and helping insurers to analyze large amounts of data quickly and accurately.

4. Personalized Services: AI insurance services can help to provide personalized services to customers. This can help insurers to better understand their customer’s needs and provide them with the best coverage.

5. Increased Security: AI insurance services can help to protect customer data from cyber threats. AI-powered systems can detect potential threats and help to safeguard customer data.

Conclusion

AI insurance services can provide numerous benefits to businesses. These services can help to streamline processes, improve risk assessments, increase efficiency, provide personalized services, and increase security. For these reasons, businesses should consider utilizing AI insurance services to improve their operations and provide better services to their customers.